“Payments modernisation for banks today involves consolidating channels and client-facing applications while aligning to global standards and trends such as ISO 20022, Open Banking APIs and 24/7 real-time instant payments. It also requires being able to add new payment networks and schemes quickly, and how to cost-effectively route any payment through the most appropriate rails to settlement – more importantly, the approach now looks at the end-end payments value chain, from client initiation to the clearing and settlement. Delivering on these requirements can involve system replacement, but just as often the challenge is to work around and integrate legacy systems that cannot easily be replaced and bring them into a more modern architecture.”

Extract from: Volante Technology and Finextra’s recent survey report ‘Payments Modernisation: The Cloud Imperative.’

The New Age of Payment Modernisation.

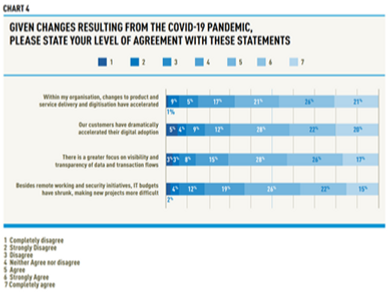

Any digital transformation and IT investment plans in 2021 need to be considered alongside the impact of the global coronavirus pandemic. There is widespread agreement that the lockdowns, restrictions, and new working practices forced on us by the pandemic have greatly increased understanding of the value of digital transformation and accelerated it.

Volante’s survey, conducted by Finextra found that 68% of organisations have seen changes to product and service delivery models accelerate since the pandemic took hold in 2020. And 70% have seen digital adoption dramatically increase in the customer base. The downside of all this change is that it is expected to be executed with smaller budgets and more stringent project approval processes.

To meet today’s challenges and satisfy the growing and ever-changing needs of their customers and the market while remaining competitive and profitable, financial institutions must concentrate their efforts on the right modernization strategy. They must capitalize on a scalable digital payment solution in a collaborative environment. This will eliminate technical challenges and provide a frictionless transaction experience, enabling them to offer value-added services to their clients.

This makes the ROI on any proposed project particularly important. What customer pain points would be solved and what would be the resulting revenue and retention upside? What costs can be cut from the business through deployment of better technology and processes? This survey finds that for most banks and payments services providers, investing in modernising their payments infrastructure passes these tests.

Post COVID, while digital transformation initiatives have accelerated, the budgets required to make things happen have not moved as much, or even shrunk. The pressure to do more with less is a familiar constant for those operating in the financial services sector but is particularly pertinent in the payments space right now. While focusing on delivering value to customers and their bottom line, modernisation and transformation initiatives are tending away from “big bang” approaches and massive IT replacement programs. Instead, more targeted approaches are being taken to modernise architectures, replacing, and upgrading selected systems, focusing on integration, and moving to cloud and “as-a-service” delivery models to improve agility while constraining costs. We expect that with more than half of organisations planning to make changes to the hosting and delivery model of their payment’s infrastructure within the next 12 months, that the current 22% of organisations using hybrid cloud and 9% engaging with a payments-as-a-service providers, will increase.

Whether it is to simply change the hosting model to benefit from the efficiency and cost reduction advantages of cloud, or a strategic move to build on Open APIs, microservices, and PaaS. It is clear cloud is imperative – allowing banks to accelerate exponentially their overall digitalization programs and address the productivity, scalability, resiliency, and future-proofing needs of their payment businesses.